|

||||||||||||

|

1. Federal Tax Updates |

||||||||||||

|

Table of Contents |

||||||||||||

|

Tax changes New individual and capital gains tax rates What’s happening for 201 9 tax returns?What is a capital asset? Increase in the Standard deduction and change in filing requirements for each filing status Temporary reduction of personal exemption to zero Adjustments to Income Alimony Moving expenses Roth IRA recharacterization rules Schedule C Provisions Elimination of entertainment expenses New Section 179 expense limits 100% expending (Bonus Depreciation) Luxury auto limits Itemized Deductions Schedule A Medical expenses State and local tax deduction and limit Home mortgage interest deduction changes Charitable contribution changes AGI limit for cash contributions No deduction for athletic tickets Repeal of exception to contemporaneous written acknowledgement Casualty and Theft loss deduction limited to only federally declared disaster areas. Suspension of miscellaneous itemized deductions subject to 2% of AGI Suspension of overall limitation on itemized deductions Credits Enhanced Child Tax Credit CTC Increase in amount to $2,000 CTC phase-out and refundable/nonrefundable amounts SSN Requirement New $500 nonrefundable credit for dependents other than a qualifying child or for a qualifying child without the required SSN Alternative Minimum Tax (AMT 20% deduction for a pass through qualified trade or business Kiddie Tax modifications Section 529 Plan changes Achieving a Better Life Experience (ABLE) account changes Discharge of certain student loan indebtedness from 2018 through 2025 Net Operating Loss (NOL) changes Affordable Care Act (ACA) provisions 201 9 continued requirement for individual insurance and Shared Responsibility paymentIndividual Mandate Penalty - eliminated for 2019 Changes in employee fringe benefits Real property depreciation

|

||||||||||||

|

1. Federal Tax Updates |

||||||||||||

| Tax changes | ||||||||||||

|

The new tax reform was finally approved by Congress on December 22, 2017. On December 22, 2017, the Tax Cuts and Jobs Act was passed by Congress. This new tax act provided reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2019”. This legislation, which the President signed into law on Dec. 22, 2017, is the most sweeping tax reform measure in over 30 years. The new legislation makes fundamental changes to the Internal Revenue Code that will completely change the way individuals and businesses calculate their federal income tax liability, so as to create numerous planning opportunities. The changes affecting individuals include new tax rates and brackets, an increased standard deduction, elimination of personal exemptions, new limits on itemized deductions (state taxes, mortgage interest), and the repeal of the individual mandate under the Affordable Care Act. The changes affecting businesses include a reduction in the corporate tax rate, increased expensing and bonus depreciation, limits on the deduction for business interest, and a new 20% deduction for pass-through business income. The foreign provisions include an exemption from U.S. tax for certain foreign income and the deemed repatriation of off-shore income. This new tax reform is the new Tax Cuts and Jobs Act (TCJA). This new tax reform was passed to take effect on both individuals and businesses. This new legislature dictates how businesses compute business interest and what business interest limitations exist under the new legislation recently passed on December 22, 2017. This new tax law will also affect the withholding on the transfer of non-publicly traded partnership interests and tax withholding me need adjustment for certain key groups. Furthermore, the new legislation affects the computing of the "transition tax" on the untaxed foreign earnings of foreign subsidiaries of U.S. companies. S corporations are also subject to the extended three year holding period for applicable partnership interests. With the new tax law changes, will come different withholding demands. The interest on home equity loans will still be deductible under the new tax law. Other items will be affected, such as the procedures for changing the accounting period of foreign corporations owned by U.S. shareholders that are subject to the transition tax under the new Tax Cuts and Jobs Act. Certain 2019 Pension Plan limitations will not be affected by the new tax law of 2017. The new law will not affect tax year 2019 dollar limitations for retirement plans. Alaska Native Corporations and Alaska Native Settlement Trusts may be able to take advantage of certain benefits that are in place in the new tax law legislation. Certain tax advantages may exist is paying items early before enacting of certain items in the new tax code take effect. One of these items is prepaid real property taxes. Real property taxes may be deductible in 2017 if assessed and paid in 2017. |

||||||||||||

| The new tax code has set forth inflation-adjustments for 2019 on various items supplied in the Revenue Code of 1986 as it was changed on November 15, 2018. Some of these changes take effect in 2019 and some old provisions will dissappear as soon as tax year 2019. | ||||||||||||

|

Provisions are set in the Act to reconcile the budget for Fiscal Year 2018 and

to temporarily modify the dollar amounts on various deductions and credits for

tax years that begin after December 31, 2017 and before January 1, 2026.

The maximum zero rate amounts are as follows: - Joint return or surviving spouse $77,200 - Individual $38,600 - Head of household $51,700 - Estate and trust $2,600 |

||||||||||||

|

The maximum 15% rate amount is as follows:

- Joint return or surviving spouse $479,000 - Separate return $239,500 - Head of household $425,5800 - Estate or trust $12,700 * Amounts will be adjusted for inflation on a yearly basis for taxable years beginning after December 31, 2018. |

||||||||||||

| The new tax code provides that for taxable years beginning after December 31, 2017 and before January 1, 2016, the value used to determine the amount of child tax credit that may be the refundable part is $1,400. This amount will be adjusted for inflation on a yearly basis for tax years beginning after December 31, 2018. | ||||||||||||

| Furthermore, as a result of the new tax code, will totally disallow any amount for the personal exemption dedutction for taxable years beginning after December 31, 2017 and before January 1, 2016. The amount of the exemption amount will be reduced to zero for taxable years 2018 through 2025. The reduction of the exemption amount to zero will not apply to the gross income limitation for the definition of qualifying relative. The exemption amount reference in the gross income test for qualifying relative will continue to be treated as $4,150 during these taxable years from 2018 through 2026 while the exemption amount stays at zero. Of course, this amount may be adjusted for inflation on a yearly basis. | ||||||||||||

| The Act is further amended to clarify that the $25,000 limitation of the cost of any sport utility vehicle under section 179(b)(5)(A) is adjusted for inflation for taxable years beginning after December 31, 2018. | ||||||||||||

| Another amendment to the Act adds section 199A, that states that if for taxable year a taxpayer has income less than the sum of the threshold amount plus $50,000 ($100,000 for joint returns), then any specified service trade or business of the taxpayer shall not fail to be treated as a qualified trade or business due to section 199A(d)(1)(A). The threshold amount is defined as being $157,500 and is adjusted for inflation for taxable years after December 31, 2018. | ||||||||||||

| The Act is amended by section 448(c) to provide that a corporation or partnership meets the gross receipts tests for any taxable year if the average annual gross receipts of such entity for the 3-taxable-year period ending with the taxalbe year which precedes such taxable year does not exceed $25,000,000. This amount will be adjusted for inflation on a yearly basis. | ||||||||||||

| In addition, the Act is amended to provide that a taxpayer's excess business loss for the taxable year is the excess, if any, of the taxpayer's aggregate deductions attibutable to trades or busineses of the taxpayer over the sum of the taxpayer's aggregate gross income or gain attibutable to such trades or businesses, plus $250,000. For joint tax returns, the amount is doubled. This amount is determined without regard to the limitation of the provision. The $250,000 amount will be adjusted for inflation on a yearly basis after Deember 31, 2018. | ||||||||||||

| The Act is also amended to include that in years when the personal exemption amount is zero, the zero amount should be substituted by the amount of $4,150 for the exemption amount. This $4,150 amount will be substituted for inflation on a yearly basis after December 31, 2018. | ||||||||||||

| The Act has also been amended to change the calculation of the inflation-adjusted amounts for qualified debt instruments and cash method debt instruments for taxable years beginning after December 31, 2017. Because of the change in the calculation of the inflation-adjusted amount in the code change, these amounts will no longer be published in a separate revenue ruling as was the done in the past. | ||||||||||||

| The Act has also been amended to provide that the applicable dollar amount used to determine the penalty under section 50000A(c) for failure to maintain minimum essential coverage is $0 for taxable years beginning after December 31, 2018. | ||||||||||||

|

The wording of the Act in section 6334(d)(4) has been changed in which it states

that in taxable years in which the personal exemption amount under section

151(d) is zero, the term "exempt amount" means an amount equal to the sume of

the amount determined under section 6334(d)(4)(B) and the standard deduction

divided by 52. The amount determined will be calculated as follows:

$4,150 multiplied by the number of the taxpayer's dependents for the taxable year in which the levy occurs. This $4,150 amount will be adjusted for inflation on a yearly basis for taxable years beginning after December 31, 2018. |

||||||||||||

|

The new tax reform was finally approved by Congress on December 22, 2017. On December 22, 2017, the Tax Cuts and Jobs Act was passed by Congress. This new tax act provided reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018”. This legislation, which the President signed into law on Dec. 22, 2017, is the most sweeping tax reform measure in over 30 years. The new legislation makes fundamental changes to the Internal Revenue Code that will completely change the way individuals and businesses calculate their federal income tax liability, so as to create numerous planning opportunities. The changes affecting individuals include new tax rates and brackets, an increased standard deduction, elimination of personal exemptions, new limits on itemized deductions (state taxes, mortgage interest), and the repeal of the individual mandate under the Affordable Care Act. The changes affecting businesses include a reduction in the corporate tax rate, increased expensing and bonus depreciation, limits on the deduction for business interest, and a new 20% deduction for pass-through business income. The foreign provisions include an exemption from U.S. tax for certain foreign income and the deemed repatriation of off-shore income. This new tax reform is the new Tax Cuts and Jobs Act (TCJA). This new tax reform was passed to take effect on both individuals and businesses. This new legislature dictates how businesses compute business interest and what business interest limitations exist under the new legislation recently passed on December 22, 2017. This new tax law will also affect the withholding on the transfer of non-publicly traded partnership interests and tax withholding me need adjustment for certain key groups. Furthermore, the new legislation affects the computing of the "transition tax" on the untaxed foreign earnings of foreign subsidiaries of U.S. companies. S corporations are also subject to the extended three year holding period for applicable partnership interests. With the new tax law changes, will come different withholding demands. The interest on home equity loans will still be deductible under the new tax law. Other items will be affected, such as the procedures for changing the accounting period of foreign corporations owned by U.S. shareholders that are subject to the transition tax under the new Tax Cuts and Jobs Act. Certain 2018 Pension Plan limitations will not be affected by the new tax law of 2017. The new law will not affect tax year 2018 dollar limitations for retirement plans. Alaska Native Corporations and Alaska Native Settlement Trusts may be able to take advantage of certain benefits that are in place in the new tax law legislation. Certain tax advantages may exist is paying items early before enacting of certain items in the new tax code take effect. One of these items is prepaid real property taxes. Real property taxes may be deductible in 2017 if assessed and paid in 2017. It took a lot of effort to finally approve the Tax Cuts and Jobs Act (TCJA) by Congress on December 22, 2017 just before the holidays. This new tax reform is the new Tax Cuts and Jobs Act (TCJA) will impact almost every taxpayer in the nation. This will take effect on both individuals and businesses. This new legislature dictates how businesses and individuals will calculate personal and business deductions and credits. Businesses which operate on foreign grounds will see a huge detriment if they don't convert soon. Some will see a huge impact on their tax returns either affecting them in a really good way or critically affecting their bottom line. The main idea behind the new Tax Cuts and Jobs Act tax reform is to fortify businesses and in turn these businesses will be able to hire employees and give these employees a better life by providing jobs. To prepare individuals taxpayers for what the new tax law really meant, there is much promotion going on as to what we are to expect in the coming years as far as credits and deductions. The new tax law is providing high individual credit and deduction amounts for now at first. Furthermore, many of the rules this time around have been placed to prevent certain credits or deductions from being taken advantage of. It is as if the current credits and deductions are too generous and changes had to be made. However, there seems to be no explanation of the fact that some deductions and credits this time around seem extremely high. There seems to be some kind of plan for these tax items to be in the extremes at first in the beginning by offering highly generous deductions at first and which will expire and go to the extremes on the other side of the spectrum. The new tax law passed on December 20, 2017, the Tax Cuts and Jobs Act displays extreme measures on both sides of the coin. |

||||||||||||

|

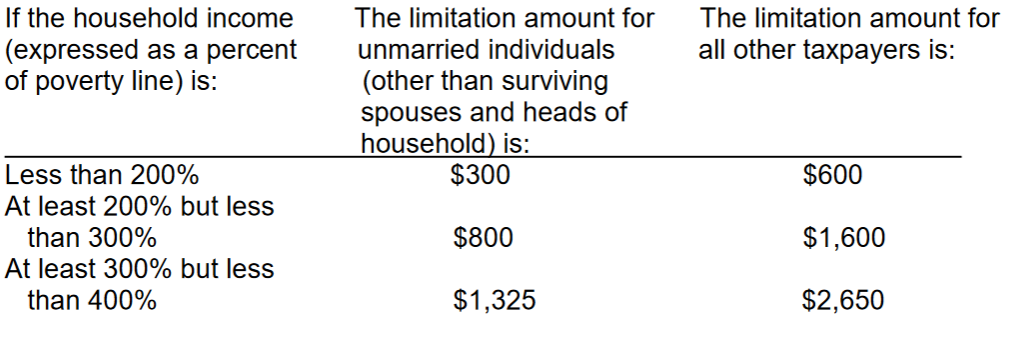

Refundable Credit for Coverage Under a Qualified Health Plan.

For taxable years starting in 2019, the limitations on tax for excess advance credit payments is determined using the following table:

|

||||||||||||

|

Rehabilitation Expenditures Treated as Separate New Building.

For tax year 2019, the per low-income unit qualified basis amount is $7,000. |

||||||||||||

|

Low-Income Housing Credit.

For calendar year 2019, the amount used to calculate the state housing credit ceiling for the low-income housing credit is the greater of $2.75625 multiplied by the state population, or $3,166,875. |

||||||||||||

|

Employee Health Insurance Expenses of Small Employers.

For tax years begining in 2019, the dollar amount in effect is $27,1000. This amount is used for limiting the small employer health insurance credit and for determining who is an eligible small employer for purposes of the credit. |

||||||||||||

|

Exmeption Amounts for Alternative Minimum Tax.

For tax year starting with 2019, the exemption amounts are as follows: Married Filing Jointly / Surviving Spouse $111,700 Unmarried Individuals $71,700 Married Filing Separate $55,850 Estates and Trusts $25,000 The excess taxable income above which the 28 percent tax rate applies is the following: Married Filing Separate $97,400 Married Filing Jointly, Unmarried Individuals (other than surviving spouse), and Estates and Trusts $194,800 The amounts used to determine the phaseout of the exemption amount are the following: Joint Returns or Surviving spouses $1,020,600 Unmarried Individuals (other than surviving spouse) $510,300 Married filing Separate $510,300 Estates and Trusts $83,500

|

||||||||||||

|

Alternative Minimum Tax Exemptions for a Child Subject to the "kiddie tax." In 2019, for a child to who the section 1(g) "kiddie tax" applies, the exemption amount for purposes of the alternative minimum tax may not exceed the sum of the child's earned income for the taxable year, plus $7,750. |

||||||||||||

|

Certain Expenses of Elementary and Secondary School Teachers.

In 2019, the amount of the deduction allowed that consists of expenses paid or incurred by an eligible educator that consists of expenses paid or incurred by an eligible educator in connection with books, supplies, computer equipment and related software and services, and other equipment, and supplementary materials used by the eligible educator in the classroom is $250. The eligible expenses do not include nonathletic supplies for courses of instruction in health or physical education. |

||||||||||||

|

Transportation Mainline Pipeline Construction Industry Optional Expense

Substantiation Rules for Payments to Employees Under Accountable Plans.

For 2019, an eligible employer may pay certain welders and heavy equipment mechanics an amount of up to $18 per hour for rig-related expenses that are deemed substantiated under an accountable plan. If the employer provides fuel or otherwise reimburses fuel expenses, up to $11 per hour is deemed substantiated. |

||||||||||||

|

Standard Deduction.

In 2019, the standard deduction amounts are as follows: Married Filing jointly and Surviving Spouse $24,400 Head of Household $18,350 Single $12,200 Married Filing Separate $12,200 Dependent Standard Deduction. In 2019, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,100 or the sum of $350 and the individual's earned income. Standard deduction for the aged or the blind. For 2019, the additional standard deduction amount for the aged or the blind is $1,300. If the individual is also unmarried and not a surviving spouse, the additional standard deduction is increased to $1,650. |

||||||||||||

|

Cafeteria Plans.

For 2019, the dollar limitation on voluntary employee salary reductions for contributions to health flexible spending arrangements is $2,700. |

||||||||||||

|

Qualified Transportation Fringe Benefit.

For 2019, the monthly limitation regarding the aggregate fringe benefit exclusion amount for transportation in a commuter highway vehicle and any transit pass is $265. The montly limiation regarding the fringe benefit exclusion amount for qualified parking is $265. |

||||||||||||

|

Income from United States Savings Bonds for Taxpayers Who Pay Qualified Higher

Education Expenses.

For 2019, the exclusion regarding income from United States savings bonds for taxpayers who pay qualified higher education expenses, begins to phase out for modified adjusted gross income above $121,600 for joint returns and $81,100 for all other tax returns. The exclusion is completely phased out for modified adjusted gross income of $151,600 or more for joint tax returns and $96,100 or more for all other tax returns. |

||||||||||||

|

Adoption Assistance Programs.

For 2019, the amount that can be excluded from an employee's gross income for the adoption of a child with special needs is $14,080. For 2019, the maximum amount that can be excluded from an employee's gross income for the amounts paid or expenses incurred by an employer for qualified adoption expenses furnished pursuant to an adoption assistance program for other adoptions by the employee is $14,080. The amount excludable from an employee's gross income begins to phase out for taxpayers with modified adjusted gross income in excess of $211,160 and is completely phased out for taxpayers with modified adjusted gross income of $251,160 or more. |

||||||||||||

|

Private Activity Bonds Volume Cap.

For 2019, the amounts used to calculate the State ceiling for the volume cap for private activity bonds is the greater of $105 multiplied by the State Population, or $316,745,000. |

||||||||||||

|

Loan Limits on Agricultural Bonds.

For 2019, the loan limit amount on agricultural bonds for first-time farmers is $543,800. |

||||||||||||

|

General Arbitrage Rebate Rules.

For 2019, the amount of the computation credit is $1,730. |

||||||||||||

|

Safe Harbor Rules for Broker Commissions on Guaranteed Investment Contracts or

Investments Purchased for a Yield Restricted Defeasance Escrow.

For 2019, a broker's commission or similar fee for the acquisions of a guaranteed investment contract or investment purchased for a yield restricted defeasance escrow is reasonable if first the amount of the fee that the issuer treats as a qualified administrative cost does not exceed the lesser of $41,000, and 0.2 percent of the computational base or, if more, $4,000; and second for any issue, the issuer does not treat more than $115,000 in brokers' commissions or similar fees as qualified administrative costs for all guaranteed investment contracts and investments for yield restricted defeasance escrows purchased with gross proceeds of the issue. |

||||||||||||

|

Gross Income Limitations for a Qualified Relative.

For 2019, the exemption amount to be used in calculations is $4,200. |

||||||||||||

|

Electrion to Expense Certain Depreciable Assets.

For 2019, the aggregate cost of any section 179 property that a taxpayer elects to treat as an expense cannot exceed $1,020,000 and the cost of any sport utility vehicle that may be taken into account under section 179 cannot exceed $25,500. The $2,550,000 limitation is reduced by the amount the cost of section 179 property placed in service during 2019 exceeds $2,550,000. |

||||||||||||

|

Qualified Business Income.

For 2019, the qualified business income threshold amount is $321,400 for married filing joint returns, $160,725 for married filing separate, and $160,700 for single and head of households. |

||||||||||||

|

Eligible Long-Term Care Premims.

For 2019, the limitations regarding eligible long-term care premiums includible in the term "medical care, are the following:

|

||||||||||||

|

Medical Savings Accounts - Self-only coverage. For 2019, the term "high deductible health plan" means, for self-only coverage, a health plan that has an annual deductible t hat is not less than $2,350 and not more than $3,500, and under which the annual out-of-pocket expenses required to be paid (other than for premiums) for covered benefits do not exceed $4,650.

|

||||||||||||

|

Medical Savings Accounts - Family coverage.

For 2019, the term "high deductible health plan" means, for family coverage, a health plan that has an annual deductible that is not less than $4,650 and not more than $7,000, and under which the annual out-of-pocket expenses required to be paid (other than for premiums) for coverage benefits do not exceed $8,550. |

||||||||||||

|

Interest on Education Loans.

For 2019, the $2,500 maximum deduction for interest paid on qualified education loans begins to phase out for taxpayers with modified adjusted gross income in excess of $70,000, and is completely phased out for taxpayers with modified adjusted gross income of $85,000 or more. The amounts for married filing joint tax returns are $140,000 and $170,000, respectively. |

||||||||||||

|

Limitations on Use of Cash Method of Accounting.

For 2019, a corporation or partnership meets the gross receipts test for any taxable year if the average annual gross receipts of such entity for the 3-taxable-year period ending with the taxable year which precedes such taxable year does not exceed $26,000,000. |

||||||||||||

|

Threshold for Excess Business Loss.

For 2019, in determining a taxpayer's excess business loss, the amount is $255,000 or $510 for married filing jointly. |

||||||||||||

|

Treatment of Dues Paid to Agricultural or Horticultural Organizations.

For 2019, the limitation regarding the exemption of annual dues required to be paid by a member to an agribultural or horticultural organization, is $169. |

||||||||||||

|

Insubstantial Benefit Limitations for Contributions Associated with Charitable

Fund-Raising Campaign - Low cost article.

For 2019, for purposes of defining the term "unrelated trade or business" for certain exempt organizations "low cost articles" are ones costing $11.10 or less. |

||||||||||||

|

Insubstantial Benefit Limitations for Contributions Associated with Charitable

Fund-Raising Campaign - Other insubstantial benefits.

For 2019, the $5, $25, and $50 guidelines for the value of insubstantial benefits that may be received by a donor in return for a contribution, without causing the the contribution to fail to be fully deductible, are $11.10, $55.50, and $111, respectively. |

||||||||||||

|

Special Rules for Credits and Deductions.

For 2019, the amount to be used in the calculation of deduction is $4,200. |

||||||||||||

|

Tax on Insurance Companies Other than Life Insurance Companies.

For 2019, the amount of the limit on net written premiums or direct written premiums (whichever is greater) is $2,300,000 to elect the alternative tax for certain small companies to be taxed only on taxable investment income. |

||||||||||||

|

Expatriation to Avoid Tax.

For 2019, unless an exception applies, an individual is a covered expatriate if the individual's "average annual net income tax" for the five taxable years ending before the expatriation date is more than $168,000. |

||||||||||||

|

Tax Responsibilities of Expatriation.

For 2019, the amount that would be includible in the gross income of a covered expatriate is reduced by $725,000. The calculated result cannot be less than zero. |

||||||||||||

|

Det Instruments Arising Out of Sales or Exchanges.

For 2019, a qualified debt instrument has stated principal that does not exceed $5,944,600, and a cash method debt instrument has stated principal that does not exceed $4,246,200. |

||||||||||||

|

Unified Credit Against Estate Tax.

For an estate of any decedent dying in 2019, the basic exclusion amount is $11,400,000 for determining the amount of the unified credit against estate tax. |

||||||||||||

|

Valuation of Qualified Real Property in Decedent's Gross Estate.

For an estate of a decendent dying in 2019, if the executor elects to use the special use valuation method for qualified real property, the aggregate decrease in the value of qualified real property for purposes of the estate tax cannot exceed $1,160,000. |

||||||||||||

|

Annual Exclusion for Gifts.

For 2019, the first $15,000 of gifts to any person are not included in the total amount of taxable gifts made during the year. For 2019, the first $155,000 of gifts made to a spouse who is not a citizen of the United States are not included in the total amount of taxable gifts made during the year. |

||||||||||||

|

Tax on Arrow Shafts.

For 2019, the tax imposed on the first sale by the manufacturer, producer, or importer or any shaft of a type used in the manufacture of certain arrows is $0.52 per shaft. |

||||||||||||

|

Passenger Air Transportation Excise Tax.

For 2019, t he tax on the amount paid for each domestic segment of taxable air transportation is $4.20. For 2019, the tax on any amount paid (whether within or without the United States) for any international air transportation, if the transportation begins or ends in the United States, generally is $18.60. However, a lower amount applies to a domestic segment beginning or ending in Alaska or Hawaii, and the tax applies only to departures. For 2019, the rate is $9.30. |

||||||||||||

|

Reporting Exception for Certain Exempt Organizations with Nondeductible Lobbying

Expenditures.

For 2019, the annual per person, family, or entity dues limitation to qualify for the reporting exception regarding certain exempt organizations with nondeductible lobbying expenditures is $117 or less. |

||||||||||||

|

Notice of Large Gifts Received from Foreign Persons.

For 2019, the Treasury Department and the Internal Revenue Service have authority to require recipients of gifts from certain foreign persons to report these gifts if the aggregate value of gifts received in the year exceeds $16,388. |

||||||||||||

|

Persons Against Whom a Federal Tax Lien is Not Valid.

For 2019, a federal tax lien is not valid against certain purchasers who purchased personal property in a casual sale for than $1,590 or a mechanics's lienor who repaired or improved certain residential property if the contract price with the owner is not more than $7,970. |

||||||||||||

|

Property Exempt from Levy.

For 2019, the value of property exempt from levy (such as fuel, provisions, furniture, and other household personal effects, as well as arms for personal use, livestock, and poultry) cannot exceed $9,540. The value of property exempt from levy (such as books and tools necessary for the trade, business, or profession of the taxpayer) cannot exceed $4,770. |

||||||||||||

|

Exempt Amount of Wages, Salary, or Other Income.

For taxable years beginning with 2019, the dollar amount used to calculate

the amount determined is |

||||||||||||

|

Interest on a Certain Portion of the Estate Tax Payable in Installments.

For an estate of a decendent dying in 2019, the dollar amount used to determine the "2-percent portion" of the estate tax extended is $1,550,000. |

||||||||||||

|

Failure to File Tax Return. The amount of the addition to tax for failure to file a tax return within 60 days of the due date of such return shall not be less than the lesser or $215 or 100 percent of the amount required to be shown as tax on such returns. |

||||||||||||

|

Failure to File Certain Information Returns, Registration Statements, etc.

For failure to file a return required relating to returns by exempt organizations and relating to returns by political organizations: Section 6652(c)(1)(A) organzation $20 daily penalty with maximum penalty of the lessor of $10,500 or 5% of gross receipts of the organization for the year. Organization with gross receipts exceeding $1,067,000 - $105 daily penalty with maximum penalty of $53,000. Penalty for managers of section 6652(c)(1)(A) organizations daily penalty of $10 with maximum penalty of $5,000. Public inspection of annual returns and reports $20 daily penalty with maximum penalty of $10,500. Public inspection of applications for exemptions and notice of status daily penalty of $20 with no limit of maximum penalty. Penalty for failure to file a tax return as required relating to returns by certain trusts and relating to terminations of exempt organizations are as follows: Penatly for failure to file a return for an organization or trust daily penalty of $10 with maximum penalty of $5,000. Penalty for managers who fail to file returns is daily penalty of $10 with maximum penalty of $5,000. Penalty for failure to file a split-interest trust return is daily penalty of $20 with maximum penalty of $10,500. Penalty for failure to file a return of any trust with gross income exceeding $266,500 carries a daily penalty of $105 with a maximum penalty of $53,000. Penalties for failure to file a disclosure return as required will incur the following penalties: Failure to file a disclosure return as required for a tax-exempt entity will have a daily penalty of $105 with a maximum penalty of $53,000. Failure to file a disclosure return as required and failure to comply with written demands will incur a daily penalty of $105 with a maximum allowed penalty of $10,500.

|

||||||||||||

|

Other assessable Penalties With Respect to the Preparation of Tax Returns for

Other Persons.

In the case of any failure relating to a return or claim for refund file in 2020, the penalty amounts are: Failure to furnish a copy to taxpayer - $50 per return or per claim for refund - with a maximum penalty of $26,500. Failure to sign a return - $50 per return or per claim for refund - with a maximum penalty of $26,500. Failure to furnish identifying number - $50 per return or per claim for refund - with a maximum penalty of $26,500. Failure to retain copy or list - $50 per return or per claim for refund - with a maximum penalty of $26,500. Failure to file correct information returns - $50 per return or per item in return- with a maximum penalty of $26,500. Negotiation of check - daily penalty of $530 per check with no limit on maximum penalty. Failure to be diligent in determining eligibility for head of household filing status, child tax credit, American opportunity tax credit, and the earned income credit - daily penalty of $530 per failure with no limit on maximum penalty that you can incur.

|

||||||||||||

|

Failure to file a Partnership Return.

In case you fail to file a partnership return in 2020, the dollar amount used to determin the amount of penalty is $205. |

||||||||||||

|

Failure to File S Corporation Return.

In case you fail to file an S Corporation return as required in 2020, the dollar amount used to determine the amount of the penalty is $205. |

||||||||||||

|

Failure to File Correct Information Returns.

In case you fail to file a corret information return in 2020, the penalty amounts are as follows: For persons with average annual gross receipts for the most recent three taxable years of more than $5,000,000, for failure to file correct information returns: The general rules is that there will be a $270 per return with a calendar year maximum of $3,339,000. If the information is corrected on or before 30 days after the required filing date then the penalty will be reduced to $50 per return with a calendar year maximum of $556,500. If the information is corrected after the 30th day but on or before August 1, the the penalty will be $110 per return with a calendar year maximum of $1,669,500.

Persons with average annual gross receipts for the most recent three taxable years of $5,000,000 or less, for failure to file correct information returns: The general rule allows for a penalty of $270 per return with a calendar year maximum of $1,113,000. If the return is corrected on or before 30 days after required filing dates the penalty is $50 per return with a calendare year maximum of $194,500. If the return is corrected after 30th day but on or before August 1, then the penalty is $110 per return with a calendare year maximum of $556,500.

Failure to file correct information returns due to intentional disregard of the filing requirement or the correct information reporting requirement. If a return other than a return required to be filed is file the penalty per return is the greater of $550 or 10% of aggregate amount of items required to be reported correctly. Calendar year maximum penalty is with no limit. If a return required to be filed but is incorrect the penalty will be the greater of $550 or 5% of aggregate amount of items required to be reported correctly and the calendar year maximu penalty is with no limit. If a return required to be filed such a return of cash receipt of more than $10,000, the penalty will be the greater of $27,820 or the the amount of the cash. The calendar year maximu penalty is with no limit. If a return required to be filed that relates to applicable insurance contracts in which certain exempt organizations hold interest is filed incorrectly, the penalty will be the greater of $550 or 10% of the value of the benefit of any contract with respect to which information is required to be included on the return. The calendar maximum penalty is with no limit.

|

||||||||||||

|

Failure to Furnish Correct Payee Statements.

In the case of any failure relating to a statement required to be furnished in 2020, the penalty amounts are the following for persons with average annual gross receipts for the most recent three taxable years of more than $5,000,000, for failure to file correct information returns: The general rule is that the penalty be $270 per incorrect return and the calendar year maximum penalty to be $3,339,000. If the return is corrected on or before 30 days after the required filing date, the penalty will be $50 per return and the calendar year maximum penalty will only be up to $556,500. If the return is corrected after the 30th day but on or before August 1, then the penalty will be $110 per incorrect return and the calendar year maximum penalty to be $1,669,500.

In the case of any failure relating to a statement required to be furnished in 2020, the penalty amounts are the following for persons with average annual gross receipts for the most recent 3 taxable years of $5,000,0000 or less, for failure to file correct information returns: The general rule is that a penalty of $270 per return be imposed and the calendar year maximum be $1,113,000. If the incorrect return is corrected on or before 30 days after the required filing date, the penalty will be $50 per return with a calendar year maximum penalty of $194,500. If the return is corrected after the 30th days but on or before August 1, the penalty will be $110 per return with a calendar year maximum penalty of $556,500. In the case of any failure relating to a statement required to be furnished in 2020, the penalty amounts are the following for failure to file correct payee statements due to intetional disregard of the reuirement to furnish a payee statement or the correct information reporting requirement: If a statement other than a statement required is respect of a return required the penalty per return will be the greater of $550 or 10% of the aggregate amount of items required to be reported correctly. The calendar year maximum penalty will be with no limit. If the payee statement required as it relates to doing business as a broker, the penalty per return will be the greater of $550 or 5% of the aggregate amount of items required to be reported correctly with no calendar year maximum limit. |

||||||||||||

|

Revocation or Denial of Passport in Case of Certain Tax Delinquencies.

For 2019, the amount considered to be of a serious delinquent tax debt is at least $52,000. |

||||||||||||

|

Attorney Fee Awards.

For fees incurred in 2019, the attorney fee award limitation is $200 per hour. |

||||||||||||

|

Periodic Payments Received Under Qualified Long-Term Care Insurance Contracts or

Under Certain Life Insurance Contracts.

For 2019, the stated dollar amount of the per diem limitaion regarding periodic payments received under a qualified long-term care insurance contracxt or periodic payments received under a life insurance contract that are treated as paid by reason of the death of a chronically ill individual is $370. |

||||||||||||

|

Qualified Small Employer Health Reimbursement Arrangement. For tax years beginning with 2019, to qualify as a qualified small employer health reimbursement arrangement, the arrangement must provide that the total amount of payments and reimbursements for any year cannot exceed $5,150. This amount is $10,450 it is for family coverage. |

||||||||||||

|

1.2 The Current Status of Tax Extenders 2019 A few provisions are set to be expiring in 2018. Whether these will be further extended is the subject of this part of our discussion. The Credit ofr nonbusiness energy property. The provision extends through 2019 the credit for purchases of nonbusiness energy property. This benefit allows a credit of 10 percent of the amounts paid or incurredc by the taxpayer for qualified energy improvements to the building such as windows, doors, skylights, and roof of principal residences. The credits allowed are of fixed dollar amounts ranging from $50 to $300 for energy-efficient property which includes furnances, boilers, biomass stoves, heat pumps, water heaters, central air conditioners, and circulating fans. This credit is subject to a lifetime cap of $500.

|

||||||||||||

|

Credit for new qualified fuel cell motor vehicles.

The credit for purchases of new qualified fuel cell motor vehicles has been extended through 2019. This is a credit for purchases of new qualified fuel cell motor vehicles. A credit is allowed that is between $4,000 and $40,000 for the purchase of such vehicles that depend on the weigh of the vehicle. There are other vehicles that may qualify for an additional $1,000 to $4,000 credit depending on their fuel efficiency. |

||||||||||||

|

Credit for alternative fuel vehicle refueling property.

The credit for the installation of alternative fuel vehicle refueling property placed in service before 2020 has been extended through 2019. This credit is available for property that dispenses alternative fuels that includes ethanol, biodiesel, natuaral gas, hydrogen, and electricity. The credit is capped at $30,000 per location for business property and capped at $1,000 for property installed at a principal residence. |

||||||||||||

|

Credit for 2-wheeled plug-in electric vehicles. This credit is extended through 2019 and it is a 10-percent credit for highway-capable, two-wheeled plug-in electric behicles. The credit is capped at $2,500. This credit requires that the battery capacity within the vehicle be greater than or equal to 2.5 kilowatt-hours. |

||||||||||||

|

Second generation biofuel producer credit.

This credit extends through 2019. This credit offers a $1.01-per-gallon nonrefundable income tax credit for second generation biofuel sold at retail into the fuel tank of a buyer's vehicle, or second generation biofuel mixed with gasoline or a special fuel and sold or used as a fuel. The credit was formerly known as the "cellulosic biofuel producer credit." |

||||||||||||

|

Biodiesel and renewable diesel incentives.

This is another credit that extends through 2019. This credits allows for a $1.00-per-gallon tax credit for biodiesel and biodiesel mixtures, and the small agri-biodiesel producer credit of 10 cents per gallon. This provision treats renewable diesel as biodiesel, except for there is no small producer credit. This credit may be claimed as an income tax credid. The mixture credit may be claimed as an excise tax payment or credit. |

||||||||||||

|

Credits with respect to facilities producing energy from certain renewable

resources.

The codes extends through 2019 the production tax credit (PTC) for certain renewable sources of electricity to facilities for which construction has commenced by the edn of 2019. The renewable sources of energy are the following: - closed-loop biomass - open-loop biomass, - geothermal - landfill gas - trash - qualified hydropower - marine and hydrokinetic renewable energy. The credit rate is adjusted for inflation and for 2017 was - 2.4 cents per kilowatt hour for power produced as closed-loop biomass and geothermal facilities and - 1.2 cents per kilowatt hour for power produced as open-loop biomass, small irrigation power, municipal solid waste, marine/hydrokinetic, and certain hydropower facilities. The PTC remains in place for 10 years following t he establishment of the facility. Alternatively, taxpayers may elect to claim a 30-percent investment tax credit instead of the production tax credit with respect to property placed in service at a qualified facility.

|

||||||||||||

|

Production credit for Indian coal facilities.

This credit is extended through 2019 and it allows for a credit of $2 per ton production tax credit for coal produced on land owned by an Indian tribe. The credit is adjusted for infration and was $2.423 per ton for 2017. |

||||||||||||

|

Railroad track maintenance credit.

This credit is extended through 2019. This credit is a credit for 50 percent of qualified railroad track maintenance expenditures paid or incurred by an eligible taxpayer. Qualified railroad track maintenance expenditures are gross expenditures for maintaining railroad track that includes roadbed, bridges, and related track structures and that is owned or leased as of January 1, 2015, by a Class II or Class III railroad. The class of railroad is deternmined by the Surface Transportation Board. As determined by the board, a class II railroad has annual operating revenues of less than $447,621,226 but in excess of $35,809,698 and a class III railroad has annual operating revenues of $35,809,698 or less. This credit cannot exceed the product of $3,500 times the number of miles of railroad track owned or leased by the eligible taxpayer as of the close of the taxable year. There is a "safe harbor" to provide that assignment of the credit shall be effective if made pursuant to a written agreement entered into no later than 90 days following the date of enactment. |

||||||||||||

|

Credit for energy-efficient new homes.

The credit for energy-efficient new homes is provided through 2019and is a tax credit for manufacturers of energy-efficient residential homes. An eligible contractor may claim a tax credit of $1,000 or $2,000 for the contruction or manufacture of a new energy efficient home that meets qualifying criteria. |

||||||||||||

|

Three-year depreciation for race horse two year old or younger.

A 3-year recovery period is assigned through 2019 for race horses two years old or younger placed in service before 2020. |

||||||||||||

|

Special allowance for second generation biofuel plant property.

An additional first-year 50-percent bonus depreciation for cellulosic biofuel faciliest is allowed through 2019. |

||||||||||||

|

Energy efficient commercial building deduciton. A deduction is allowed through 2019 for energy efficiency improvements to lighting, heating, cooling, ventilation, and hot water systems of commercial buildings. A $1.80 deduction per square foot for construction on qualified property is included. A partial $0.60 per square foot is allowed if certain sybsystems meet energy standards but the entire building does not. The subsystems are - the interior lighting systems - the heating - cooling - ventilation - hot water systems, and - the building envelope

|

||||||||||||

|

Special rule for sales or dispositions to implement FERC or STate electric restructuring policy for qualified electric utilities. In 2019, you can elect to recognize gain from qualifying electric transmission transactions ratably over an eight-year period beginning in the year of sale if the amount realized from such sale is used to purchase exempt utility property within the applicable period. |

||||||||||||

|

Excise tax credits relating to alternative fuels.

In 2019, a $0.50-per-gallon excise-tax credit or payment for alternative fule and a $0.50-per-gallon credit for alternative fuel mixed with traditional fuel. The alternative fuel credit is for fuel used in motor vehicles, motor boat, or airplane. The mixture credit is not limited to type of transportation. In addition, the rules have been modified regarding the mixture compenent of the credit in which the liquefied petroleum gas, compressed or liquefied natural gas, and compressed or liquefied gas derived from biomass, are not eligible to be included in an alternative fuel mixture. |

||||||||||||

|

Seven-year recovery period for motorsports entertainment complexes.

The new tax code provision assigns a 7-year recovery period for motorsport entertainment complexes placed in service before 2020. For this rule, a motorsports entertainment is a racing track facility that is permanently situated on land and that hosts one or more racing events within 36 months of its placed-in-service date. |

||||||||||||

|

Accelerated depreciation for business property on an Indian reservation. For 2019, you are able to claim accelerated depreciation for qualified Indian reservation property placed in service on or before December 31, 2019. The qualifications require that property must be primarily used for business purposes within a reservation, owned by somone unrelated to previous owner, and unrelated to gaming practices. This deduction also extends to the alternative minimum tax. |

||||||||||||

|

Special expensing rules for certain film, television, and live theatrical

productions. Through 2019, a taxpayer can deduct up to $15 million of the aggregate cost ($20 million for certain areas) or qualifying film, television, or theatrical production in the year the xpenditure was incurred.

|

||||||||||||

|

Indian employment tax credit.

The Indian employment tax credit is extended through 2019 and provides a credit on the first $20,000 of qualified wages and qualified employee health insurance costs paid to or incurred by the employer for each qualified employee who works in an Indian reservation. A qualified employee is: - Someone who is an enrolled member of an Indian tribe, or - The spouse of an enrolled member. - Employee who performs substantially all of the services for the employer with an Indian reservation. _ Who's principal place of abode is on or near the reservation in which services are performed. The credit is 20 percent of the excess of eligible employee qualified wages and health insurance costs incurred during the current year over the amount of such wages and costs incurred by the employer during 1993. |

||||||||||||

|

Mine rescue team training credit.

Employers can claim a credit through 2019 equial to the lesser of 20 percent of the training program costs incurred, or $10,000, for the training program costs of each qualified mine rescue team employee. |

||||||||||||

|

Exclusion from gross income of discharge of qualified principal residence

indebtedness.

The provision provides through 2019 a maximum exclusion from gross income of $2,000,000 for a discharge of qualified principal residence indebtedness. In general, the indebtness must be the result of acquisition, construction, or substantial improvement of primary residence. The exclusion has been modified to apply to qualified principal residence indebtedness that is discharged pursuant to a binding written agreement entered into before January 1, 2020.

|

||||||||||||

|

Mortgage insurance premiums treated as qualified residence interest. Qualified mortgage insurance premiums are treated as interest for purposes of the mortgage interest deduction through 2019. The deduction phases out for taxpayers with adjusted gross income (AGI) over $100,000. This phase-out amount is $50,000 if taxpayer is filing married filing separately.

|

||||||||||||

|

Above-the-line deduction for qualified tuition and related expenses. For 2019, an above-the-line deduction is allowed for qualified tuition and related expenses for higher education. The deduction is capped at $4,000 for an individual with AGI that does not exceed $65,000 or $2,000 for an individual with AGI that is less than $80,000. For married filing joint taxpayers the deducitons are capped at $130,000 and $160,000, respectively.

|

||||||||||||

|

Empowerment zone tax incentives.

Tax renefits are provided through 2019 for certain businesses and employers operating in empowerment zones. There are 40 specifically designated geographic areas designated as empowerment zones. The following tax benefits are included: - tax exempt bond financing - A Federal income tax credit for employers who hire qualifying employees - Accelerated depreciation deductions on qualifying section 179 equipment and - Deferral of capital gains tax on the sale of qualified assets sold and replaced.

|

||||||||||||

|

American Samoa economic development credit. Through 2019, the American Samoa economic development credit may be claimed against U.S. corporate income tax in an amount equal to the sum of certain percentages of a domestic corporation's employee wages, employee fringe benefit expenses, and tangible property depreciation allowances for the taxable year of the active conduct of a trade or business in American Samoa. The American Samoa economic development credit is available only to a domestic corporation that claimed the now-expired section 936 possession tax credit for American Samoa for its last taxable year beginning before January 1, 2006. |

||||||||||||

|

Temporary reduction in medical expense deduction floor.

Individuals can claim an itemized deduction for unreimbursed medical expense using a lower threshold of 7.5 percent through 2019. |

||||||||||||

|

Extension of oil spill liability trust fund rate. An excise tax of 0.09 per barrel is imposed on crude oil received at a refinery and petroleum products entered into the United States and deposited into the Oil Spill Liability Trust Fund. This provision expired at the end of 2018. Now the provision reinstates the excise tax beginning on the first day of the first claendar month beginning after the date of enactment. |

||||||||||||

|

Black lung liability trust fund excise tax. The rate of tax on coal was $1.10 per ton for coal from underground mines and $0.55 per ton for coal from surface mines (each up to 4.4 percent of the sale price) until it expired through the end of 2018. Now (after 2018), the rates declined to $0.55 per ton for coal from underground mines and $0.25 per ton for coal from surface mines (each up to 2 percent of the sale price). This provision reinstates the higher rates on coal through 2019, effective the first day of the first month beginning after the date of enactment. |

||||||||||||

|

Disaster Tax Relief.

This bill provided disaster tax relief benefits to individuals and businesses affected by major disasters occuring in 2018. These benefits included special rules allowing access to retirement funds, a special credit for employee retention during business interruption, suspension of limits on deduction for certain charitable contributions, special rules for deductions for disaster-related personal casualty losses, and special rules for measurement of earned income for purposes of qualifications for tax credits. |

||||||||||||

| New individual and capital gains tax rates | ||||||||||||

|

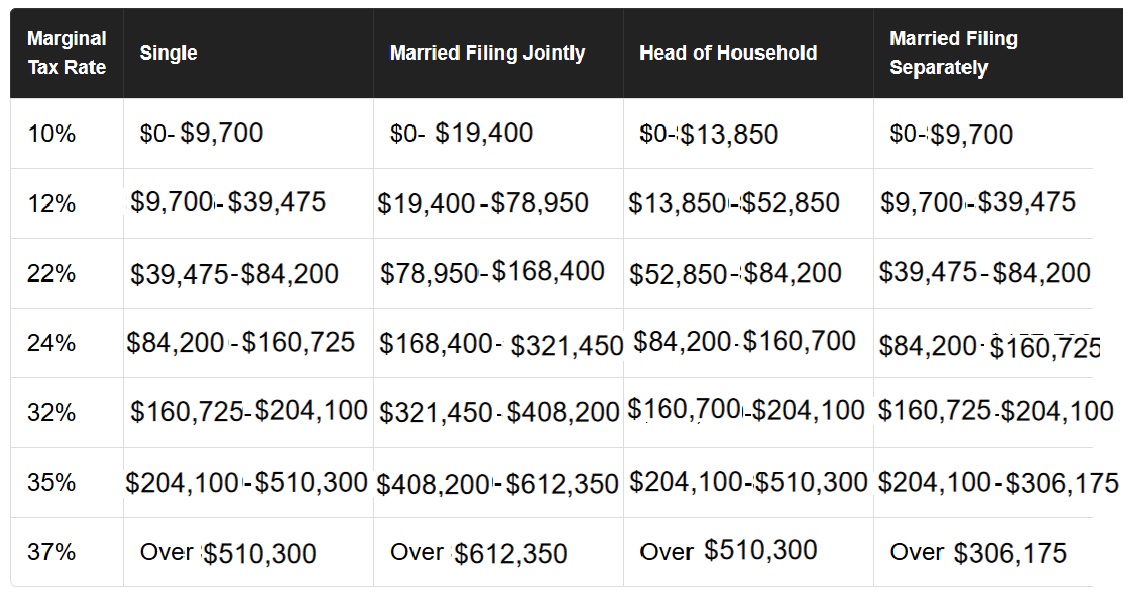

The new administration

campaign tax plan was that the number of tax brackets would reduce from

seven to three. Similarly, the House of Representatives’ original tax reform

bill contained four brackets. Ultimately, common sense interceded and we are

still at the seven-bracket structure. There is just no way, we will ever

have a postcard tax return with all these many tax brackets! The tax rates are

lower with about 2 % less than with the previous tax brackets but starting

at 10%.

The marriage penalty is almost gone. What is the marriage penalty? This penalty does not really exist as a specified penalty anywhere but it is widely talked about. Why? The marriage penalty is a concept that takes place with the change is the tax bill after a couple marries. The “marriage penalty” or the higher tax bill is due to the combined income of the couple and as a result of the combined income, the couple is changed to a new tax bracket and thus new tax rate which will usually result in paying more taxes than if the couple remained single. In a few instances the opposite can be true. Instead of a marriage penalty, the couple could incur a bonus which means that the couple fairs better by filing their tax returns as married filing jointly than when they file their tax returns as single. Thus, the couple will have a gain resulting in a bonus instead of a penalty. Again, these are widely spoken about, but there is not per say a “marriage penalty” or “marriage bonus” and these are merely the result of calculations after applying the different tax brackets at the married rates and at the single rates. Other items also affect couples that would cause a “marriage penalty” such as the ability of the individual to file as head of household when the individual is single and thus would not qualify for this HOH filing status once the individual gets married. Additionally, the individual will no longer qualify for the Earned Income Credit because of the combined income as a married individual. Remember this, the marriage penalty is not an actual penalty. It is something that happens as a result of the different tax bracket (7 tax brackets). The only thing a taxpayer can do to completely eliminate this penalty or the possibility of the marriage penalty is plan your taxes before marriage. It is a well-known fact that when couples plan to marry, the last thing on their mind is the marriage penalty. If you earn more, your income tax bracket will be higher and that only makes sense. An individual who is not married is single for tax purposes. A couple who is married is considered one individual for tax purposes and thus their income is taken together as one individual. When the couple gets married, the income will usually increase tremendously unless one of the individuals in the marriage is not working. If the income increases, then the tax bracket and the tax rate also increases. The higher tax as a result of getting married is the marriage penalty. The marriage penalty would be the higher tax and the loss of credits and deductions as a result of the marriage. What is a capital asset? Almost everything you own or use for person or investment purposes is a capital asset such as your car, household furnishings and stocks. Stocks or bonds would be items that are considered capital assets which you hold for investments. When you sell these items, the difference is a capital loss or a capital gain. Then, after that, you must determine if your assets are a short-term or a long-term item and then you will apply the tax rate. The capital gains tax rates if you have a gain, of course. If you have a loss, you usually you can deduct up to $3,000 of it. Please note that this amount is $1,500 if you are married filing separately. You have this limit and once you reach the maximum you can deduct for the year, you usually can either carry the excess forward to other years. Anyways, if you held the item for less than a year, this property is considered short-term and thus you would have a short-term capital gain and you held your asset for more than a year, then you asset is considered long-term. The tax rate on most of these capital gains is usually no more than 15% for most taxpayers. It can even be 0% if you're in the 10% or 15% ordinary income tax brackets. This is your tax bracket for your other income such as your W-2 wages. However, if you exceed certain thresholds, then your capital gains may be taxed at 20%. These thresholds are the thresholds for ordinary income tax bracket that is 39.6%. For example, if you are single and your ordinary income is $418,400 then your tax rate could be 39.6% and thus your net capital gain would be taxed at 20%. Likewise if you are married filing jointly or qualifying widow (er) that threshold is $470,700 and $444,550 for head of household. For married filing separately, this amount is almost half at $235,350. Other than being at a tax bracket of 39.6% and being taxed at the 20% capital gain rate, there are other situations. Your capital gains may be taxed at rates greater than 15% if 1. The taxable part of the capital gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. 2. Net capital gains from selling collectible are taxed as a maximum 28% rate. 3. The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate. The items discussed above usually apply only to long-term capital gains, but short term capital gains are taxed differently. Notice that net short-term capital gains are taxed as ordinary income. These gains are from property you hold for less than a year. Income is due as you earn it, so if you know you are going to have to pay capital gains tax, then you should plan accordingly and even make estimated payments. The new tax provisions in the above mentioned is that the tax rate on most net capital gain is no longer higher than 15% for most taxpayers. That is, unless you go over the thresholds mentioned or you are selling section 1202 qualified small business stock. If you are selling section 1202 qualified small business stock then it is taxed at a maximum 28% rate. Also, if you are selling collectibles your maximum rate is 28%. The portion of any unrecaptured section 1250 gain from selling this section 1250 real property is taxed at a maximum of 25% rate. Other than this, the capital gain is not higher than 15%. |

||||||||||||

| Increase in the Standard deduction and change in filing requirements for each filing status | ||||||||||||

| The new Tax Cuts and Jobs Act will increase the standard deduction amount to $12,000 for individuals, to $18,000 for head of household and to $24,000 for married couples filing jointly and surviving spouses. If you are age 65 or over, blind or disabled, you can add on $1,300 to your standard deduction if you are single, or an extra $1,600 if you are married. For individual taxpayers, you will be required to file a tax return if your gross income for the taxable year is more than the standard deduction. If you are married, you would add your spouse’s income to the picture and if the income added together is more than the standard deduction for married filing jointly, then you must file a tax return. | ||||||||||||

| Temporary reduction of personal exemption to zero | ||||||||||||

| The personal exemption which is normally adjusted for inflation every year has been changed by the TCJA to $0. Inflation works by taking a percentage of the inflation increase, but no matter how you put, anything percent of $0 will always be $0. This is to remain from January 1, 2018 through December 31, 2026. | ||||||||||||

| Adjustments to Income | ||||||||||||

|

There is an advantage in being able to claim

deductions directly from gross income - the above-the-line deductions, in

arriving at adjusted gross income. This is because these adjustments are allowed

even if you claim the standard deduction rather than the itemized deductions on

Schedule A of Form 1040. Another advantage of these over-the-line deductions is

that they also reduce state income tax for taxpayers residing in state that

compute tax based on federal adjusted gross income.

What are these adjustments to income that help you arrive at AGI? A few examples of over the line deduction that help you arrive at AGI are

These are only a few of the possible deductions that help you arrive at AGI. Adjustments to income are expenses that are applied before any taxes. These reduce your total income. These are the items you enter on your Form 1040 before you apply your standard deduction, itemized or your exemptions. After you calculate adjustments to income you are left with your adjusted gross income. Adjustments to income are individual retirement arrangement (IRAs), alimony, bad debt deduction, moving expenses, student loan interest deduction, tuition and fees deduction, and the educator expense deduction. |

||||||||||||

| Alimony | ||||||||||||

|

For almost forever, the rules have been that

alimony is deductible by the payer spouse, and the recipient spouse must include

it in income. Now with the new tax legislation, alimony is treated differently.

No longer will there be an incentive for a payer of alimony to pay alimony. Why?

This is for the simple reason that the payer will not be able to deduct it. That's why.

Before this, the payer would deduct it and the payee would have to report it in

income. Now neither can the payer deduct it, nor is the payee required to report

alimony in income because the new Tax Cuts and Jobs Act (TCJA) has changed the

alimony rules. However, there it a catch, this new law only applies for alimony

payments required by post-2018 divorce agreements. If the alimony payments are

made under a pre-2019 divorce agreement, then we continue to deduct alimony as

usual. This new tax law treatment of alimony starts for alimony divorce or

separation instruments which are executed after December 31, 2018 and thus no

more deduction for payments or including the payments in income for alimony

instruments that are executed after this date.

There are two things. The new tax law treatment of alimony payments will apply to payments that are required under divorce or separation instruments that are (1) executed after December 31, 2018 or (2) have been modified after that date and if the modification specifically states that the new tax law now applies. |

||||||||||||

| Moving expenses | ||||||||||||

|

The rules for moving expenses have changed with

the new Tax Cuts and Jobs Act (TCJA). You still need to know how the old rules

work though because based on these rules any reimbursements you get from your

employer will be taxable or nontaxable. Other than that, you will not be able to

deduct moving expenses any longer, unless you are in the military.

The requirements to deducting moving expenses are that your move closely relates to the start of work, you meet the distance test, and that you also meet the time test. If you are a member of the Armed Forces and your move was due to military order and a permanent changer of station, you don't have to satisfy the distance test. If you are in the military and have to move due to military order, you can still take a moving expense deduction on your tax return. The moving expense deduction suspension is for December 31, 2017 through December 31, 2025. Starting January 1, 2018 and beyond, you will no longer be able to deduct moving expenses on your tax return. Yes, this is another attempt at making your tax return as simple as sending in a postcard. The Tax Cuts and Jobs Act was passed in December 2017 and has eliminated the moving expense deduction. This deduction elimination is not permanent and may revert after 2025 and may depend on who is in charge at that time. It may come back at that time and at that time it will up to Congress or the individual in charge to eliminate it permanently. This means that if you moved before 2018 you may be able to claim the moving expense deduction and if you move in 2026, you may be able to claim a moving expense deduction. By the way, many of the tax law changes such as the suspension of the moving expense deduction are temporary and only for the periods of 2018 through 2025. At that time, we will know what will come back and what will stay eliminated. |

||||||||||||

| Roth IRA recharacterization rules | ||||||||||||

|

The new Tax Cuts and Jobs Act (TCJA) has removed

your ability to recharacterize your Roth IRA conversions. This could have a

major impact on financial planning for many taxpayers.

How do recharacterization work and why it is useful? A recharacterization allows you to treat a regular contribution made to a Roth IRA or to a traditional IRA as having been made to the other type of IRA. You are only allowed to make a contribution to an IRA to a certain limits and these limits are up $5,500 for 2018 or $6,500 if you are 50 or older. Different rules apply if you contribute to a traditional IRA and if you contribute to a Roth IRA or the tax treatments are different for each kind of IRA. You recharacterize by telling your trustee of the financial institution holding your IRA to transfer the amount of the contribution plus earnings to a different type of IRA which is either a Roth IRA or a traditional IRA. This is done either in a trustee-to-trustee transfer or to a different type of IRA with the same trustee. This works by making the transfer by the due date for filing your tax return (including extensions) and you treat the contribution as made to the second IRA for that year as if you made it to the second IRA for that year as if you never made it to the first IRA. Starting January 1, 2018 for tax year 2018, you will not be allowed to do this any longer as dictated with the new Tax Cuts and Jobs Act legislation. Hence, a conversion from a traditional IRA, SEP or SIMPLE to a Roth IRA can no longer be characterized. In addition, the Tax Cuts and Jobs Act also prohibits recharacterizing amounts rolled over to a Roth IRA from other retirement plans such as 401(k) or 403(b) plans. However, you have until October 15, 2018 to recharacterize a Roth IRA conversion made in 2017 and this can recharacterized as a contribution to a traditional IRA. As already discussed a Roth IRA conversion made on or after January 1, 2018 cannot be recharacterized. One thing to note is that you can still recharacterize by rolling out excess contributions to a Roth IRA. Do this if you contribute early in the year to a Roth IRA, but then earn to much over the phase-out limits, thereby disqualifying you from being able to contribute to a Roth IRA for the year. You can undo this contribution without being subject to an excess contribution penalty tax by recharacterizing the contribution to an IRA. You can still do this regardless of the new tax law changes (Hopkins 2018). It is important to note that the reason people are characterizing from one IRA to another is the fact that these are two different products that are treated differently in the tax code. With a traditional IRA for example, you get a tax deduction up front and taxes are delayed until you withdraw your money when you retire and the idea is that at that time your tax rate will be a lot lower. With Roth IRA, the IRA is funded with post-tax money and with a Roth IRA your tax rate when you retire will be zero. Therefore, recharacterizing an IRA is changing how taxes will apply to the IRA. But now, the new Tax Cuts and Jobs Act (TCJA) has removed this ability to recharacterize and this could have a major impact on financial planning for many. |

||||||||||||

| Schedule C Provisions | ||||||||||||

| We use Schedule C of Form 1040 to report our income or loss from a business or a profession as a sole proprietorship. In some rare circumstances, such as in a husband and wife operation, we use Schedule C to report income from a partnership. Your business or the kind of work that in considered Schedule C income is income that has a primary purpose of engaging in making money or in making a profit. Rarely does anyone go into business to not make money. You are usually involved in the business with continuity and regularity because you are hoping to make money from your efforts. Many individuals start out their business because they love what they do and thus their business is their passion or hobby and they end up making a lot of money from it. Well, as long as you meet the IRS rules for considering your hobby a business, then you have a business. These rules as mentioned above are that you are in the business with the primary purpose of making a profit and that you are involved in the activity with continuity and regularity. | ||||||||||||

| Elimination of entertainment expenses | ||||||||||||

|

Could it be that entertainment expense deduction

is one of the most abused business deductions and that is why it is being

eliminated? Maybe. The Tax Cuts and Jobs Act, has eliminated the entertainment

expense deduction. This new rule starts for any business activities after

January 1, 2018. The new law has done away with business entertainment expenses

for everyone - from small business owners to C corporations. No one is exempt

from this and if you are Sole-proprietor, S-Corporation, LLC, independent

contractor and business entrepreneur, this new law affects. However, don't get

us wrong. No one is telling you that you cannot entertain your customers, in

fact you must. Entertaining your customers is an integral part of doing business

regardless if you are going to get a deduction for it or not. Do yourself a

favor and don't go around telling your customers that you cannot entertain them

anymore and worst don't tell them that the new tax law does allow you to do so.

You should still entertain, but this time you, the business owner, will pick up

the tab. Regardless if it is deductible or not, entertainment expenses will

continue in business and maybe it is a shame that a business owner will not be

able to deduct these. Just because it will no longer be deductible after January

1, 2018, does not mean this activity will stop. Some will probably sacrifice

business in the name of there being no deduction for their entertainment

expenses, but many will be wise and still continue to entertain, because

entertaining their customer will continue to be a necessary business expense. At

least in our American culture it is.

Yes, indeed, entertainment expenses are very necessary for your business to succeed. Good news, though. Remember that part of the entertainment expense that is for meals? Well, you can generally take 50% of your business-related meal expenses are allowed as a deduction. You can still entertain your customers, but you pick up the tab for the entertainment part and the IRS will pick up the tab for 50% of the meal part. To be able to deduct 50% of your meals as a business deduction though, the meal expense must be ordinary and necessary in carrying on your trade or business and this expense must still meet the directly related test or the associated test. Remember though, that these limitations only apply to your relationships with customers and not with your employees. Don't get all confused and start setting your own limits that are not included in the new Tax Cuts and Jobs Act. The expenses that are still deductible, and we mention this only so that you get this ingrained in your head, are expenses for your employees that are for 1. Entertainment, amusement and recreation expenses which you treat as compensation to your employees and of course you must include these in their wages. 2. Entertainment expenses for recreation, social, or similar activities and facilities for employees. Please note that you cannot call entertainment expenses those expenses that you incur for entertainment goods, services, and facilities which you have for sell to customers. Come on, these are called cost of goods sold. Also, again, remember that with the entertainment expense elimination as with the other elimination of deductions, that they are only temporary. The elimination is from 2018 through 2025. At that time, in 2025, we will see, how all this works out. Who knows, someone with enough sense will re-establish these provisions that have for such a long time become a part of who we are. In America we can deduct business expenses for entertaining our clients, we can golf and transact business at the same time, we can... Don't worry our America will come back to us, after all this chaos is over, we will be great again! |

||||||||||||

| New Section 179 expense limits | ||||||||||||

|

The new Tax Cuts and Jobs Act, has made

adjustments to the Section 179 depreciation limits. The Section 179 deduction

allowance was re-instated on December 18, 2015 as part of the PATH Act -

Protecting Americans from Tax Hikes Act of 2015. This act allowed the Section

179 expense to be expanded to $500,000 annually and it included a maximum bonus

depreciation of 50 percent for property put into service until December 31,

2017.

Section 179 allows taxpayers to immediately expense the cost of qualifying property rather than taking depreciation deductions in yearly increments. The maximum amount that a taxpayer can deduct has been increased with the new Tax Reform. The maximum amount a taxpayer can deduct now in Section 179 deduction for property placed in service after December 31, 2017 has been increased from $520,000 to $1,000,000. Along with this increase there is also a phase-out threshold from $2,070,000 to $2,500,000 for property placed in service after 2017. Once the amount for the total Section 179 property placed in service during the year exceeds the threshold amount, then that is when the phase out occurs and at that point the deduction will be reduced dollar-for-dollar by the excess amount. As with other tax items, the deduction and the phase-out limit amounts will be increased for inflation starting in 2019 and in later years. Under the new tax law, the qualifying property for Section 179 expensing now also includes certain depreciable tangible property used in connection with lodging and improvements to non-residential real property such as roofs, heating, ventilation, air conditioning, and fire and alarm protection systems. For many businesses and corporations, this is an excellent tax savings brought about with the new Tax Cuts and Jobs Act. |

||||||||||||

| 100% expending (Bonus Depreciation) | ||||||||||||

|

The PATH Act law states that starting January 1,

2018, bonus depreciation will begin scaling back with the ability to deduct 40